When you take the route to become an entrepreneur, you may hear the term business credit often. Your mentor and network may recommend the importance of building business credit. But before we explore how to build a good credit score, it’s important to know what is business credit.

We can define business credit as the financial reputation of a business. It represents the risk factor, or in other words, the ability of your business entity to pay off debts. So, a good credit score is 80+ on a scale of 0-100.

After setting up a new small business, you would be quite busy setting up operations. Due to such a busy routine, you may want to skip looking into business credit. Instead, you may want to take the easy route by using personal credit for business matters.

Business credit holds equal, if not more, importance as other aspects of a business. So, separate your personal credit from business credit to avail the following benefits:

- Better chances to Qualify for a loan

- Easier loan terms with lower interest rates

- Lower insurance premiums

- A good score suggests your business is reliable

- Easier to negotiate terms with suppliers

- Long-term financial stability

Table of Contents

ToggleBuilding Business Credit: Smart Tips

Poor credit history can make it challenging to qualify for loans in the long run. So, take action to build a good credit score from day one of launching your business.

Choose the Right Business Structure

Before registering your business with authorities, make sure you choose the right business structure. In order to separate your personal credit from business credit, you should make your business an LLC, LLP, or corporation. That’s because your business won’t be a separate legal business entity if it’s a sole proprietorship.

Get Your EIN

For businesses based in the US or US territories, you would need an Employer Identification Number (EIN) for taxation purposes. You can apply for your EIN online through the IRS website. With your EIN ready, you can apply for a DUNS number.

The Data Universal Numbering System (DUNS) is issued by Dun & Bradstreet which is one of the “Big Three” credit bureaus in the country. This nine-digit unique identification number maintains a record of your credit history. You can apply for your DUNS online for free.

The other top credit bureaus don’t require you to apply for a unique identification number.

Don’t Forget a Separate Business Account

The key to establishing business credit for new business is to keep your personal finances separate from business finances. So, refrain from using your personal bank account to process business payments.

Visit a bank as soon as you can to open a business account. Further, apply for a credit card solely for business use.

Look into Business Credit Card Options

You can gain startup capital in different ways. You can use your savings, do crowdfunding, ask your network for loans, or get venture capital from investors.

This startup capital may be enough to cover business expenses for at least six months to a year. When you have enough cash, you may decide to use these funds to pay for expenses in cash. But this isn’t a good idea since it may lead to cash flow problems.

Instead, you should look for suitable credit cards for your company. It’s best to apply for a card that offers 0% APR for small businesses. Also, find out whether there are rewards or sign-up bonuses available. Not only will a credit card help prevent cash flow issues, but also help increase your business credit score. Just make sure you make optimal use of your credit card limit.

How to Make Optimal Use of Credit Cards

Your credit score depends on several factors including credit utilization. So, using your credit card will benefit you as long as you are careful. On the other hand, irresponsible use of a credit card can push you into a pitfall you may struggle to get out of.

So, here’s how you can make smart use of your card:

- Use the business credit card for necessary expenses

- Only charge what you can afford to pay off by month’s end

- Try to charge no more than 30% of your monthly credit limit

- Clear your credit card bill every month to avoid the accumulation of interest rates

- Avoid cash advances – It can be as high as 30%

Clear Your Dues Early

Lenders want to be sure they will get their amount as per the agreed terms. Your business credit history represents your trustworthiness to assure them.

Therefore, clear all your dues on-time – utility bills, credit card bills, payments to creditors, etc.

And it would be even better if you can pay your creditors earlier than expected. It’s because D&B has a special metric, called PAYDEX Score. With a range between 1 and 100, only those businesses can earn a good score that make early payments.

PAYDEX Score represents your payment history. So, a score above 80 can help you make a good impression.

Make Sure Your Suppliers Report to Credit Bureaus

When choosing a new supplier or vendor for your new business, make sure they report to one of the top three business credit reporting agencies: Dun & Bradstreet, Experian Commercial, and Equifax Small Business.

However, if you already chose suppliers without paying attention to this factor, you can request them to start reporting purchases and payments to a credit bureau. With timely or early payments, you can boost your credit score and build a good credit history profile.

Also, set up trade lines with your suppliers. This way, you can obtain inventory in advance and pay a few weeks later.

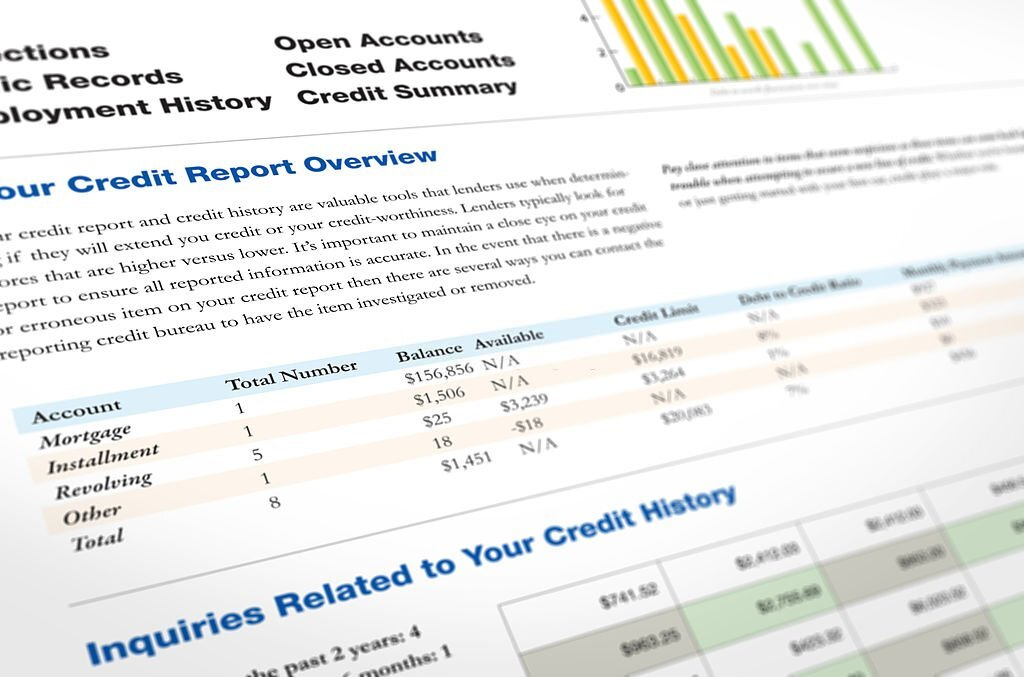

Monitor Your Credit Report

Monitor your credit reports every month. For this purpose, go to the websites of three major credit agencies (D&B, Experian, and Equifax) and take a detailed look at your credit profiles.

At times, you may notice the information has errors or it’s outdated. If that’s the case, contact the reporting agency to inform them about the issues and resolve them at the earliest.

Conclusion

Do you want to know how long does it take to build business credit?

Building business credit for a small business takes time. You can’t get a good credit score overnight. But good practices with financial matters can help you raise your credit score and improve your trustworthiness.

So, keep your personal and business finances separate, be careful with credit utilization, clear dues on time, and regularly monitor your credit profile. With this strategy, you can establish credit and reap its benefits when your business needs funding.